陈浩庭短评:为何澳洲经济会继续改善

澳洲商业信心指数攀升至自2008年以来最高,因为销售和利润皆保持强劲成长,企业对未来也更加有信心。

陈浩庭, 董事总经理 / 授权代表, 摩根

Raymond Chan, Managing Partner / Authorized Representative, Morgans

储备银行喺之前嘅政策会议上都表示过,增长将恢复稳定,包括大宗商品的前景有改善。

好多时我地都会听到一啲分析话,因为供应在短期内受阻,价格会有支持。当然除左供应外,需求亦好紧要嘅,澳洲储备银行在八月公布的金融政策声明中,有两点就系关于需求。

第一点是国际经济发展,因为大宗商品需求与中国息息相关。2017年上半年中国国内生产总值轻微上升,主要由扩张性财政政策支持,当中有需求增长,特别是来自服务业的需求,工业的需求仍然好稳健,包括对钢材的需求,支持澳洲铁矿砂的出口。

中国需求增加亦刺激原材料价格上升,大宗商品价格兑一篮子货币,在去年升百分之 32,同期铁矿砂价格升百分之 15,两种主要类别嘅煤,焦煤同燃煤分别升百分之 72 同百分之 32。

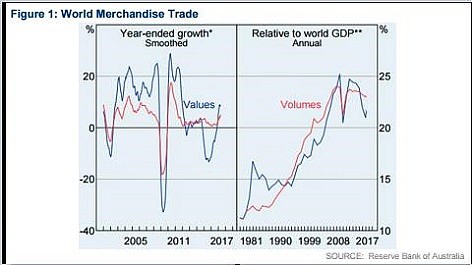

声明值得留意嘅第二点,叫做「全球商品贸易回升」,呢度指嘅商品贸易,易包括一般制造业商品同大宗商品,储银留意到呢方面嘅活动自去年起上升,截至今年 5 月全年,在商品总价值上升百分之 9。

储银认为,贸易活动对经济状况非常敏感,当全球需求回升,贸易一定回复得比需求更快。

从图一可以睇到,贸易总价值在 2016 年急跌后又回升,储银认为,同旧年起环球经济增长回稳有关,当中以今年上半年嘅升幅尤其明显。

Chart showing World Merchandise Trade

中国自 2016 年年中开始,重拾对澳洲矿产嘅需求,不单系澳洲,巴西同俄罗斯都同样受惠,从而带动全球商品价格回升,澳洲的贸易比价指数亦显著改善。

储银认为,多项嘅因素反映贸易增长会持续改善,细心睇,货运指数亦向好,全球经济增长喺未来几年,唔应该会太差。反映财长莫理逊最近对澳洲经济改善嘅预测,系基于事实嘅。

Disclaimer(s): Morgans Financial Limited or Morgans Corporate Limited has acted in a corporate advisory capacity in the last 12 months for the companies listed and received fees in this regard.

The author may own, trade or intend to trade the shares discussed above.

The information contained in this report is provided to you by Morgans Financial Limited as general advice only, and is made without consideration of an individual's relevant personal circumstances. Morgans Financial Limited ABN 49 010 669 726, its related bodies corporate, directors and officers, employees, authorised representatives and agents (“Morgans”) do not accept any liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of information contained in this report, or for any errors or omissions contained within. It is recommended that any persons who wish to act upon this report consult with their Morgans investment adviser before doing so.

+61

+61 +86

+86 +886

+886 +852

+852 +853

+853 +64

+64